(Bloomberg) — Shares of Sacks Parente Golf Inc. fell. by 85% on Wednesday, erasing almost all of the sizable first-day gains that made it the strongest US stock market debut of 2023.

Most Read from Bloomberg

Shares of the company, which makes golf equipment including putters for $400, closed at $4.47 on Wednesday. That wiped out most of Tuesday’s rally that pushed the stock up 624% from its $4 IPO price.

The decline extends to the volatile trading that marked Sacks Parente’s first trading day, as the stock stalled out at least five times during Wednesday’s session due to the degree of price movements.

Read more: $400 street vendor becomes the best IPO of 2023 with a gain of 624%

Even with the losses, the company is trading above its IPO price. The listing is the latest sign of a revival of interest in new stock listings, following initial public offerings by consumer companies such as Oddity Tech Ltd. , the parent company of SpoiledChild and Il Makiage, and the Cava Group Inc. chain. quick.

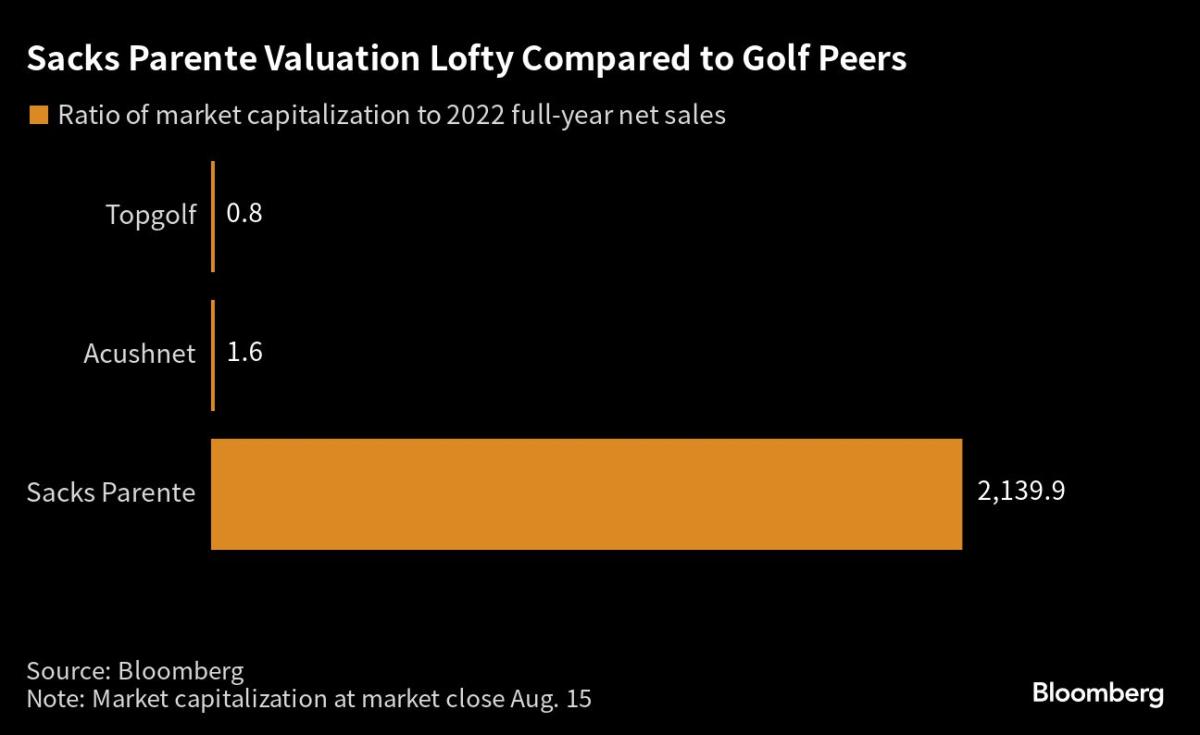

Still, the market value of Sacks Parente’s shares of nearly $63 million dwarfs its $190,000 in sales from last year. By comparison, rival Topgolf Callaway Brands Corp. was valued at $3.1 billion at the close on Tuesday, but brought in nearly $4 billion in annual revenue. Similarly, Acushnet Holdings Corp. had a market capitalization of $3.6 billion at Tuesday’s close and $2.3 billion in 2022 sales.

(Update stock movements when the market closes)

Most Read by Bloomberg Businessweek

© 2023 Bloomberg LP