-

Michael Perry placed $1.6 billion in hypothetical bets against the S&P and Nasdaq last quarter.

-

The Big Short investor is a “one-trick pony” and his bet is off, said analyst Mark Chaykin.

-

Chaiken argued that the previous Bears were smarter, more influential, and had better track records than Barry.

Michael Bury shocked Wall Street this week reveal Place bets with Face value $1.6 billion against the Standard & Poor’s 500 And Nasdaq 100 The last quarter. But one veteran analyst thinks his obvious bet on a stock market crash is a losing bet.

Mark Chaikin, Founder and CEO of Chaikin Analytics, “He would be as wrong as Mike Wilson was,” Benzinga said this week. He was referring to the chief US equity analyst at Morgan Stanley, who was surprised by the historic rally in stocks this year and issued a mea culpa In late July.

Chaiken rejected the notion that Burry’s portfolio update spooked retail traders into selling shares this week.

“I promise no one on Reddit follows Michael Burry,” he said. “They are in their own world.”

In fact, the main driver of the stock meme craze in early 2021 was Berry I invested in GameStop In 2019, he wrote several letters to the heads of retail video game stores that highlighted excessive short interest in exchange for their stock. There is, too poultry science subreddit with 17,000 members dedicated to Pre study And track his trades.

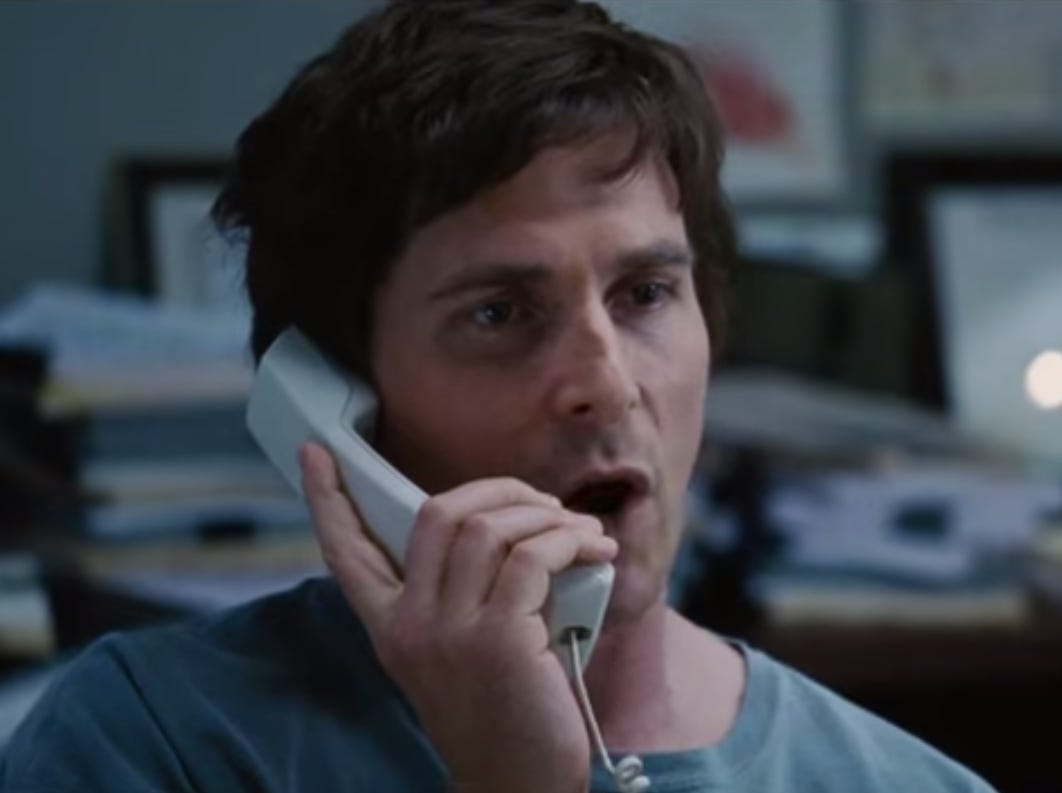

He also shrugs off Chaiken Berry as just another market doomsday, noting that his only notable achievement was predicting and profiting from the housing crash of 2008. The cross bet Chronicled in the book “The Big Short,” actor Christian Bale portrayed Burry in the film adaptation, making Burry a household name.

“There’s always Michael Bury, whether it’s a bond guy, or whether it’s sometime Stan Druckenmiller, or Paul Tudor Jones,” Chaykin said. “By the way, they are much smarter than Michael Berry with a great track record.”

“It’s a one-trick pony as far as I’m concerned,” added the stock analyst expert.

However, Burry has made several minute calls in recent years. For example, it is warned Inflation could become an issue as early as April 2020.

When price growth reached a 40-year high last summer, he said I predicted correctly It will sink in a matter of months. he is too Sound the alarm on meme stocks and cryptocurrencies before they plunged last year.

Investor Scion Asset Management held bearish put options on 200,000 shares of both SPDR S&P 500 ETF Trust And Invesco QQQ Trust Index funds that track the S&P 500 and the Nasdaq-100, respectively, on June 30. The combined face value of the property was $1.6 billion.

Burry’s options can only be hedges, and they’ll cost him a fraction of that amount. But they are still “very large” positions given that Scion’s remaining portfolio was only worth $111 million, says Jerry Fowler, head of European equity and global derivatives strategy at UBS, he said from the inside.

Unlike Burry – who follows his latest bets Repeated warnings to Historical asset price bubbles And epic accidents Chaiken said the S&P 500 is in a bull market, and he predicted it wouldn’t drop even 10% from its high in late July.

Read the original article at Business interested