The end of earnings season always presents an opportunity to see what’s in store for the following months. With the second-quarter results of companies in the energy sector now available, it’s time to consider the key investment themes ahead in the space.

This is exactly what Goldman Sachs analysts do. While the energy team remains “building” the ESCOs as a whole, moving forward, they see the “importance of outstanding self-help drivers” as a key theme that will lead to outperformance.

“We believe there are a number of attractive buy-rated stocks that can drive sequential growth, margin expansion and multi-channel expansion even in a range-bound commodity environment with Brent crude near $80 per barrel,” the team explained in a recent note.

Against this background, Goldman Sachs experts have identified two specific names that present such “distinctive opportunities”. In fact, they are not alone in their endorsement of these stocks. According to the TipRanks platform Both rated Strong Buys by Street analysts. Let’s take a closer look.

Weatherford International (WFRD)

For investors with a keen interest in the energy sector, oil field services are emerging as a lucrative field. These companies provide vital services that major producers rely on to finish well projects, implement specialized equipment, extract oil and gas from below the surface of the earth, and efficiently store the resulting products. While exploration and production groups often claim the limelight, there is a significant capacity gap between the discovery of underground oil reserves and the operational management of the wells responsible for extraction. This is exactly where companies like Weatherford come into play, ingeniously bridging a critical gap and ensuring a smooth continuity of operations.

Weatherford can trace its business roots back to more than 80 years, and has accumulated a wealth of experience. Today, the company operates in 75 countries on six continents, bringing cutting-edge automation technology from the digital age to the traditional heavy industry in the oil field. Among Weatherford’s unique technical advantages is the One Offshore One Trip Completion System, which allows upper and lower installations to be completed on the same project for greater efficiency and faster start-up for offshore oil projects. The company also makes extensive use of RFID-enabled technology in its facilities – again, an innovation that improves efficiency.

The company’s ability to deliver results has led to strong financial performance over the past several quarters — which in turn has driven the company’s share price higher. The stock is up 70% so far this year, based on the company’s strong results.

Looking at these results, we found that Weatherford reported $1.27 billion in the top line in Q2 ’23. This was an increase of 7% year-over-year and exceeded expectations of $38.5 million. The company’s cash generation has also improved over the past year. In the second quarter, Weatherford generated $201 million in cash from operations, and adjusted free cash flow of $172 million. Those numbers were up year-over-year from $60 million and $59 million, respectively. In the company’s net profit, the stock price was at $1.14 per share, 4 cents below expectations.

Looking ahead, Weatherford has stepped up its forecast for the entirety of 2023. The company now expects moderate to high teens revenue growth for this calendar year, along with more than $400 million in adjusted free cash flow.

Obviously, investors were willing to forgive the loss of earnings and focus on a slew of other positive metrics. That’s a position shared by Goldman Sachs analyst Ati Modak, who sees Weatherford’s increased guidance for the full year and its ability to deliver outside efficiencies as key points.

“WFRD was among the only companies to revise guidance this earnings season, which we believe is a reflection of the company’s specific drivers and increased visibility around the strength of the business. We also believe that the additional downgrade of the remaining secured securities and potential commencement of the dividend are positive catalysts for the stock.

“WFRD is one of the few international exposure services stock ideas that allow investors to gain exposure to secular themes for expanding reserve capacity and momentum overseas. As such, we believe that with continued execution and strength in earnings revisions, the stock should eventually revalue higher. Modak continued.

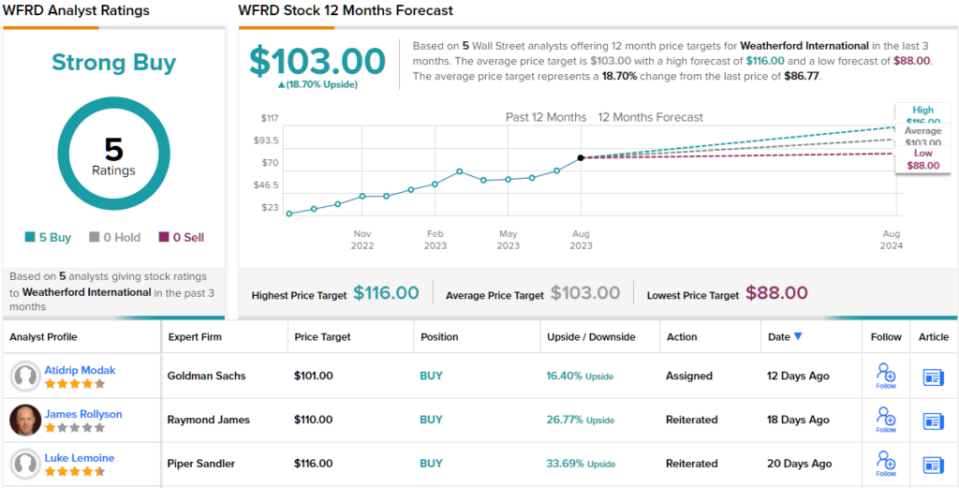

Accordingly, Modak rates WFRD stock a Buy, and its $101 price target implies an upside of 16% for the next 12 months. (To view Modak’s history, click here)

Overall, Weatherford has a Strong Buy consensus rating based on 5 recent unanimous positive analyst reviews. The stock is selling for $86.77 with an average price target of $103, slightly more bullish in Goldman’s view, suggesting an upside of roughly 19% in the one-year horizon. (be seen Weatherford stock forecast)

Baker Hughes Corporation (bkr)

Next up is Baker Hughes, another oilfield services pioneer. This company works with advanced industrial technology, developing and deploying the latest developments to smooth the path for industrial companies looking to streamline clean and reliable energy solutions. Baker Hughes provides its services directly in the oil sector, in petroleum and natural gas production, as well as in support areas such as natural gas liquefaction and gas turbines.

Baker Hughes has a global reach, employing approximately 55,000 workers in more than 120 countries. Oil fields are notoriously dangerous workplaces, but Baker Hughes was able to report 217 “perfect HSE” days last year — days without incidents causing harm to people, equipment or the environment.

In July, Baker Hughes reported its results for the second quarter of ’23, and it showed beats across the board. Total revenue came in at $6.3 billion on the top line, exceeding expectations by about $49 million and growing 25% year-over-year. The end result, non-GAAP EPS reported at 39 cents, was six cents better than estimates.

The strong financial results also brought in strong cash flows. Baker Hughes generated $858 million in cash from operations during the second quarter, up 86% year-over-year. This included $623 million in free cash flow, up from just $147 million in the previous year’s second quarter.

The company also maintained the dividend, announcing on July 27 a payment of 20 percent per common share. This was up 5% from the previous quarter, and up 11% year-over-year. The annual common stock dividend of 80 cents gives a yield of 2.25%.

The stock has caught the attention of Neil Mehta, a five-star Goldman Sachs analyst, who points to its strength both as a winning cow and as a defensive move.

“The company’s operational transformation is shaping up, driving potential for improving EBITDA margins, as well as strong macroeconomics in both segments…we continue to see BKR as an attractive defensive stock with elements of a turnaround story and exposure,” said Mehta.

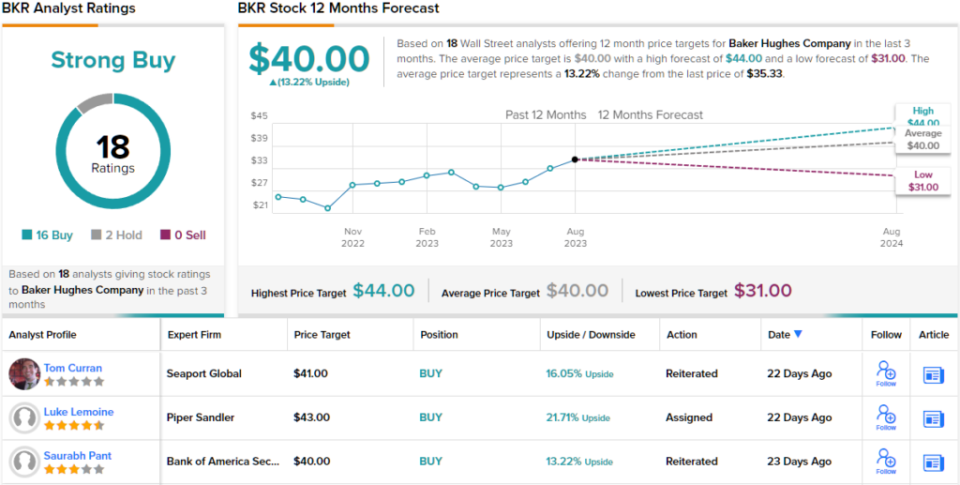

Gauging his stance, Mehta put a buy rating on BKR shares, and set his price target at $42. This target indicates room for a potential upside of approximately 19% for one year from current levels. (To watch Mehta’s track record, click here)

Overall, there are at least 18 recent analyst ratings for Baker Hughes stock, and they split 16 to 2 in favor of Buys over Holds — for a Strong Buy consensus rating. The stock is currently priced at $35.33 and carries an average price target of $40, which indicates that it will gain 13% in the next year. (be seen BKR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best stocks to buya newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.